By Alison Izat

With the Covid-19 Pandemic upon us, we’re all experiencing a sudden change to our work and home lives and an increasing level of uncertainty as to what the future looks like. It is possible you or someone you know will need financial support now or in the very near future as a result of changes to work schedule, childcare arrangements, income or other related factors. Financial emergencies can be stressful and cause considerable hardships, so it is important to take positive steps now to help you and your loved ones maintain good financial health during these challenging times.

Here at Plan Institute, we’ve prepared a number of tips and guidance to help you prepare and stay on top of finances, as well as some tips and tricks to ease the pressure over the coming weeks.

Income Assistance

The first place to look for support is from upcoming financial support packages recently announced by the federal government. Through the COVID-19 Economic Response Plan, there is a promising amount of direct support for individuals, families and small to medium-sized businesses. It’s important to keep abreast of changing requirements or further announcements. An overview of the Economic Response Plan can be found at this link.

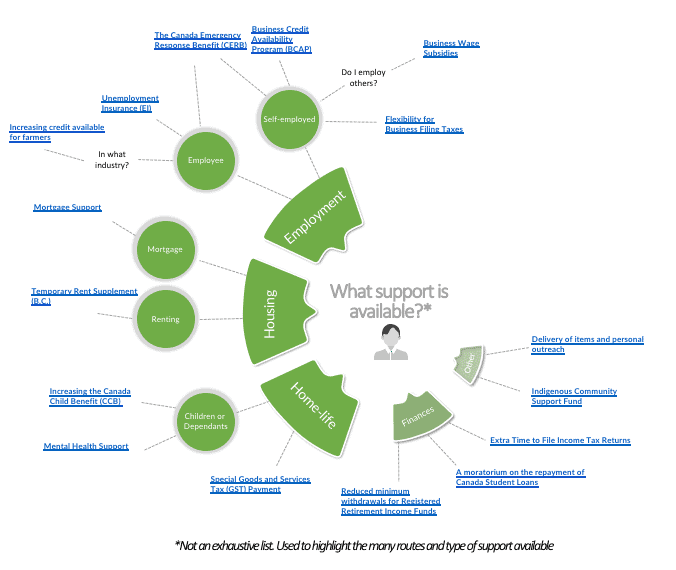

Provincial assistance is also available for the majority of provinces. Be sure to check in on these directly at your provincial website. You should regularly visit and keep a note of the benefits and changes applicable to your situation. Consider all aspects which you may be eligible for; your role as a parent, whether you’re self employed, have student loans or rent a home, for example. We’ve summarized some of these characteristics you may want to consider into a diagram:

Remember: To benefit from these supports, it is important you be registered for the CRA My Account Portal. This service enables you to file your tax returns remotely and will most likely be part of the government’s process for rolling out financial support and benefits. Sign up for e-service with CRA My Account Portal to begin the process!

Considering An RDSP Withdrawal?

It may seem tempting to withdraw funds from an existing RDSP or similar long-term financial savings schemes. Unfortunately, the RDSP is not very flexible for withdrawals in the short term. It has been designed as a long-term savings vehicle which primarily acts as a pension replacement for people with disabilities. Early withdrawals are possible but will result in high penalties including repayment of government grants and bonds. Some example scenarios including an explanation of the 10-year rule can be found on the RDSP.com FAQs here.

Consider the other options available before making withdrawals from your long-term savings plans; could you ask friends or family for help? What other sources of income could you generate? Do you have income from a trust? Could you sell something you don’t use or don’t like? If you are struggling, then as a last resort, you want to proceed with an RDSP withdrawal, our article, How Do You Get Your Money Out is very helpful in outlining the withdrawal rules and giving examples.

Tips and Tricks for Saving

Even if you aren’t in a difficult situation right now, it may be a good idea to start saving in order to prepare for a possible change in circumstances down the line. We’ve provided some tips and tricks for increasing your saving potential – we’d love to hear what other ideas you have also come up with!

- Make or revise your budget. If you don’t budget already, listing income and expenses for each month can highlight immediate areas for a reduction. Study your budget to see if you can eliminate any non-essential expenses such as subscriptions to magazines you don’t read anymore. Can you find ways to reduce essential services? Many utility services are helping out at this time, by extending due dates for bill payments, free community wifi access, and no roaming charges. Start an online budget today through the Government of Canada’s Budget Planner. Or, Plan Institute’s Future Planning Tool which helps you consider the elements required in a future plan. And, don’t forget there are many easy to use budgeting apps available for use on your smartphone.

- Start an emergency fund. Simply put, this is an easily accessible pool of funds you can use when times are difficult. This may be difficult to budget for right now, however if after doing your budget and adjustments of spending you find yourself in a positive position, start a savings/emergency fund to keep money aside for future disruptions. Guidance on setting up an emergency fund can be found here.

- Clearing and consolidating credit balances. If you have outstanding debts or rely on credit for stability, consider other ways to reduce high payments to credit card companies. Contact your bank about delaying payments or consolidating any outstanding debts to a lower interest option. Sometimes new credit cards offer 0% interest on a balance that is transferred in. If you’re able to pay off debts, ensure to do this regularly to avoid high charges.

- Delay mortgage payments. Federal assistance has already been announced with some financial institutions offering delays to upcoming payments. Check with your bank or their online supports if that is an option available to you. With lower interest rates, you may also want to consider renegotiating a lower repayment rate or refinancing your mortgage with other debts at a lower interest rate.

- Pare back for a while by canceling or reducing non-essentials such as excess phone data – you will most likely be using home Wifi most of the time! What else are you not using? Yoga or a gym pass, car insurance? Refunds are being offered on monthly transit passes in B.C., for example.

- Use what you have. This is the rainy day you have been saving for! Use your gift cards, spare cash and coupons lying around the house. File any outstanding medical claims, invoices for work you’ve done or call in those favors you’ve stocked up.

- Staying home is good for your health and your finances. Eat-in and avoid take-out. Look for free delivery of groceries or special offers and coupons. Apps and add-ons such as Honey and Groupon can help you find good deals on essentials and treats when you can afford them!

- Can you take on a job like helping a neighbor with dog walking or cutting the lawn? There are online platforms that can help connect you with local, one-off jobs, such as Task Rabbit.

- Use income from a trust. Our recent article on using trusts during a pandemic suggests ways in which you can use a trust to help provide financial support.

Generally, the best advice for uncertainty is to be prepared. Each step you take now will help you feel stronger, give you peace of mind for the future and hopefully help you overcome many challenges. As with all financial matters, your situation will be different and a unique one, so remember to seek advice specific to your circumstances. Similarly, you may wish to utilize Plan Institute’s Helpline, (1-844-311-7526). This is a free service, providing you with 1:1 support from one of our family experts, who can help with questions about the Disability Tax Credit, the Registered Disability Savings Plan, estate planning, advocacy approaches, government benefit programs, social network building and more.

Alison Izat is a Certified Financial Planner from Vancouver, BC. She also works as a Helpline Advisor and RDSP Workshop Facilitator for Plan Institute.